Table Of Content

These are generally only needed for mobile devices that don't have decimal points in their numeric keypads. So if you are on a desktop, you may find the calculator to be more user-friendly and less cluttered without them. Note that the Help and Tools panel will be hidden when the calculator is too wide to fit both on the screen. Moving the slider to the left will bring the instructions and tools panel back into view. Enter the original loan term in the number of years (whole years only).

Learn more about paying off your mortgage early

If your bank receives your money two weeks in advance for the life of your loan, then they can begin earning interest on that money and investing it two weeks earlier. Accrued over the lifetime of a mortgage loan, this adds up to a considerable profit for a bank. You should have this knowledge on hand when they try to distract you by saying that receiving your money more quickly does them no good, as many bankers will. Determine if there’s room in your budget for this new total — and don’t forget to factor in other debts, household costs, and expenses. Our Early Mortgage Payoff Calculator will help determine your new monthly mortgage payments required to reduce your amortization period based on your mortgage balance, mortgage rate, and current payments. By adding an additional payment on top of your monthly payment, you can pay off your mortgage faster and reduce your total interest costs over the lifetime of your mortgage.

Related Tools

Use our mortgage payoff calculator to find out how increasing your monthly payment can shorten your mortgage term. To learn what your monthly payment will be based on your home price, interest and more, use our mortgage calculator. The home mortgage is a type of loan with a relatively low interest rate, and many see mortgage prepayments as the equivalent of low-risk, low-reward investment. For this reason, borrowers should consider paying off high-interest obligations such as credit cards or smaller debts such as student or auto loans before supplementing a mortgage with extra payments.

What Is an Underwater Mortgage and What Are Your Options?

Is It a Good Idea to Pay Off Your Mortgage Early? - CNET

Is It a Good Idea to Pay Off Your Mortgage Early?.

Posted: Sat, 27 Apr 2024 07:47:34 GMT [source]

There are so many variables to consider and decisions to be made; consider doing some of that work in advance of going to see your lending institution. It can save a ton of money down the road (while maybe enduring a little financial stress (or put another way, financial creativity or ingenuity on your part) in the interim. It’s safe to say that, should your specific agreement with your lending institution allow for it, it’s probably never a bad idea to pay your mortgage off early.

However, deciding to wait might be a better choice if you have concerns about your monthly cash flow—say because the economy is shaky or you’re hoping to retire soon. As you use the calculator, there are some mortgage terms that you might need to know. If you happen to have a new loan worth $300,000, you can try recasting.

Effective Ways to Pay Down Home Loans Earlier

It behooves the smart home owner to find ways to pay off a mortgage as early as possible in times of economic volatility. In a situation where a house is paid off or at least has some positive equity in it, the real estate can serve as an added buffer against any other financial troubles that a home owner may face. In a macroeconomic environment that is full of insecurity, home owners have a special responsibility and opportunity.

If you don't know the remaining loan term

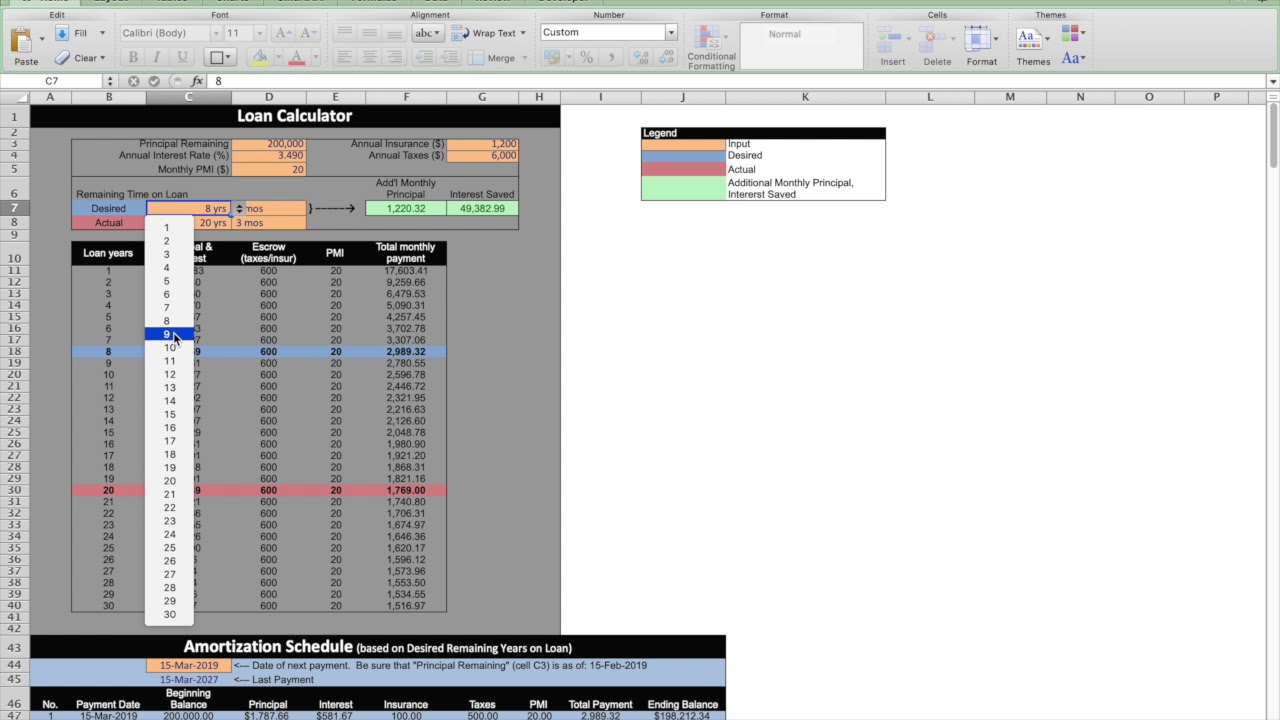

Once you’ve completed filling in that information, your current mortgage payback numbers will appear, including principal and interest, balance paid, balance owing, etc. A very simple query, for example, would be to adjust the loan term (amortization), say from 25 to 15 years. That means you would be paying off your mortgage 10 years earlier than originally stipulated in your mortgage agreement. You would see that your monthly payments would increase as a result, but that the interest would be significantly reduced over the long term.

How To Use This Mortgage Payoff Calculator

First of all, make sure that you did not sign a contract that penalizes you for paying off your house early. If you have yet to sign the documents that solidify the terms of your loan with your financial institution, make sure that this provision is not included in the wording. This can be tricky; a reputable real estate lawyer without ties to your financial institution should be consulted in order to make sure that this is the case. If you have already signed financial documents with this early bird provision, you should do your absolute best to renegotiate your agreement so that it is taken out.

Is there any penalty for paying off the mortgage early?

But if you can comfortably fit it within your monthly budget (meaning the payment is at or below 25% of your take-home pay), it’ll totally be worth it. And don’t forget, you’ll likely have boosted your income or lowered your cost of living from the time you first took out your mortgage—in that case, you’d definitely be able to handle the bigger payment. Banks try to hide these arrangements behind too good to be true interest rates.

This is how much interest you will pay if you just continue to make your current monthly payment. Enter the dollar amount you still owe on your loan (without the dollar sign). Note that the amount cannot be arrived at simply by multiplying the payment amount by the number of payments remaining. Although there are three major credit reporting companies, all of whom use completely different methods to calculate a credit score, you never know which one a bank will use in relation to you. For this reason, get your free credit report from all three agencies, Experian, TransUnion and Equifax, and compare the scores for discrepancies. If you would like to save the current entries to the secure online database, tap or click on the Data tab, select "New Data Record", give the data record a name, then tap or click the Save button.

Contrary to popular belief, refinancing is not always to the advantage of the home owner. The downside to this strategy is that the payments for a 15 year fixed rate mortgage will always be substantially higher because of the shorter time frame. Our rate table lists the best current mortgage rates available from our lender network. Set your search criteria by entering your loan data and selecting the relevant products from the dropdown, click search and we'll help you compare the market by showing you the most relevant offers for homeowners.

For the same $200,000, 30-year, 5% interest loan, extra monthly payments of $6 will pay off the loan four payments earlier, saving $2,796 in interest. Use this calculator if the term length of the remaining loan is not known. The unpaid principal balance, interest rate, and monthly payment values can be found in the monthly or quarterly mortgage statement. If you want to see how much time and money you’d save making extra house payments in your specific situation, check out our free mortgage payoff calculator.

No comments:

Post a Comment